FXCM: The Forex brokerage company

FXCM can be considered by most traders as the “grandfather” of Forex brokers, along with the others who were later listed on the New York Stock Exchange in 2001. Ever since then, FXCM has grown rapidly, expanding its services to clients all across the United States, Europe, Africa, and the Asia Pacific albeit, some may consider the growth a shaky and unstable one. To illustrate the growth of FXCM as a brokerage company and how it has affected the market we know today, the company has a firm foothold on the market’s share and has managed to conduct a staggering average of $1 billion in trading volume monthly. FXCM’s regularization is a unique one at that as it is one of the few Forex brokers that have been regulated by almost all the leading, most trustworthy, and authentic authorities around the world such as the United States’ CFTS and the NTS, the United Kingdom’s FCA, Canada’s IIROC, Germany’s BaFin, France’s ACP, Italy’s CONSOB, South Africa’s FSB, Hong Kong’s SFC, and last but not the least, Australia’s ASIC.

As we’ve brought up before, FXCM is a powerhouse name and brand for Forex trading; however, its history hasn’t been the most respectable as one would have hoped for it to be.

FXCM: Reputation and History

Although with a long, illustrious line of success, FXCM’s history has been rocky, especially after major authorities had penalized it in the United States and the United Kingdom for many malpractices and fraudulent behavior towards its client base. Back then, many of its investors had been left cheated out of their money due to FXCM’s trading policies and conditions. Even today, many in the profession would express skepticism and doubt when referring to FXCM. Whatever it may be, FXCM’s history and reputation haven’t brought the company down. From recent observations, many newcomers say that the company has learned the error of their ways and is doing its best to put their clients’ interest at priority.

Today, as it has grown in size and fame, FXCM seems to be dealing with a newer problem. While the brokerage company does offer decent spreads and trading conditions, FXCM, however, has found themselves in direct competition with more streamlined and advanced brokerage firms with much more to offer, giving FXCM a hard time to keep itself above water in the modern, mainstream market.

FXCM: Signup and Trading Services

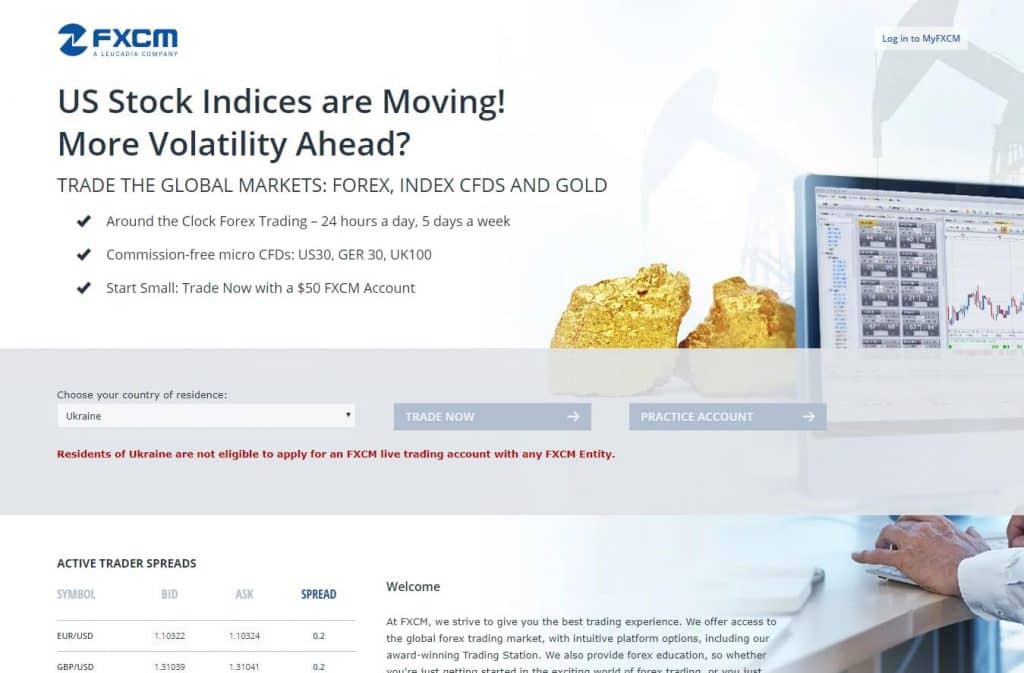

In terms of sheer size and reach alone, FXCM is huge. Though, this gives FXCM’s products and services barred to certain clients depending on their location and country. This is due to the strict regulations given by the authorities of a country and can prove to be of inconvenience to some trading with them.

This would mean that the services and conditions offered are not the same. For example, in the United Kingdom, a brokerage company doesn’t need to impose any restrictions on its client base; therefore, FXCM clients in the U.K. can have access to and trade with spread betting and binary options.

Another example is in the United States, where FXCM’s leverage starts at an increased level of 1:400. Keep in mind, though, that leverage decreases as the client’s account equity increases.

Also, according to the implemented regulations of the CTFC and NFA, Forex brokerages must include maximum leverage of 1:50 with no hedging capabilities, utilizing the “First In, First Out” rule. This could certainly muddle things up for the well-traveled of FXCM clients.

That aside, FXCM accounts come in 3 types – the Mini, Standard, and V.I.P. accounts, which can differ in terms of the quality of services and commission per trade. FXCM also features a Demo account for traders to enter and trade in a simulated market environment risk-free.

Below is a brief run-through of the details regarding the mentioned account types.

Mini Account

With FXCM’s The Mini account (or the Market Maker account), you get spreads starting from 1.5 pips with a maximum leverage level of 1:200. This leverage level would stay as so until a maximum of £5,000 ($6,580 approx.) inequity has been reached.

Standard Account

When opening a Standard account with FXCM, a minimum deposit of £5,000 would be required. FXCM’s Standard account is an Electronic Communication Network affair that allows your spreads to start at 0 pips flat. However, there is a minimum commission of $0.5 per trade – though this could increase depending on the lot size attained.

V.I.P. Account

FXCM’s best in service, but also just as costly. The V.I.P. account (or Active Trader account) is available to FXCM’s clients, who have deposited a minimum of £25,000 ($32,921.62 approx.). The V.I.P. account features tighter spreads and commissions as well as some of the best ECN conditions and account manager access. Furthermore, it also offers its clients free VPS.

FXCM: Trading Platform & Payment Options

Platform-wise, FXCM utilizes a variety of trading platforms such as MetaTrader4, NinjaTrader, and FXCM’s own TradingStation. Each platform is available in most mobile stores and is compatible with a majority of android and iOS mobile and tablet devices for on-the-go traders.

FXCM’s payment options include Credit and Debit cards, mainstream e-payment services, and bank-to-bank wire transfers.

Conclusion

At first glance of FXCM’s account deposit, one may say that its requirements are rather costly than most Forex brokers, and they wouldn’t be wrong for thinking so. Recently, FXCM has been criticized for taking its brand name and recognition for granted and as an excuse to raise its prices. Therefore, if FXCM’s expenses are of concern to you, it is advisable to check other alternatives with much better trading conditions.

Some in the trading community may express that FXCM is a good broker, while others may express otherwise. In the end, FXCM does what most brokers have, and it’s really up to you as a trader to know and be responsible for the risks you are willing to take.