Coinbase exchange review: Why use it?

Coinbase is one of the two top choices of cryptocurrency exchanges. If you’re just entering the market, it’s either this or Binance. Both offer a very extensive line of products and services, and, importantly still, they have adequate client support. Smaller exchanges might not have this luxury.

But that’s not the reason to trust blindly. What exactly does Coinbase have to offer? Does it balance out whatever flaws they might have? Let’s find out.

What is Coinbase?

Coinbase was launched in 2012 in California. It was basically during the starting years of crypto trading. Naturally, it means they’ve gathered a lot of clients and content over the years.

Coinbase is bigger or not much behind Binance in terms of client and coin traffic (the exact numbers are hard to find). If doesn’t just tell you how respectable or trustworthy the exchange years. More users mean more liquidity, and that translates into the speed with which you trade.

Coinbase doesn’t have too many unique quirks. The smaller exchanges might come up with something unheard of to boost their attractiveness and user numbers. CB is a relatively old exchange, so they don’t really need anything of the sort. They do provide additional services, but they mainly focus on the pure trading process.

And they do have a lot to offer in this department.

Trading on Coinbase

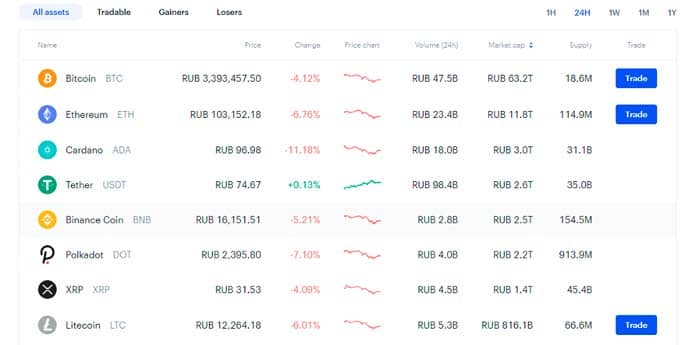

In terms of sheer amount of assets and trading infrastructure, Coinbase has virtually no competition. There are 4125 currencies available on this platform. Certainly, it makes for a very sizeable currency market, even if many of these currencies are only tradable in Bitcoin or Ethereum.

The exchange includes:

- Leading coins, like Bitcoin or Ethereum

- Regular coins, like Dogecoin or Litecoin

- Lesser-known coins from all over the Internet

- Tokens – limited-use currencies issued by companies as inner means of payment

So, if you happen to have some small-time coins that aren’t available on most exchanges, you can try looking on Coinbase.

Plus, every single of these coins is provided with a dynamic variable that displays the progress of their price on the market. There isn’t really any extensive software, but you do have an ability to monitor and plan your actions (especially since the platform has a pretty thorough learning section).

Lastly, it’s important to note that there are several coins issued by Coinbase themselves (or those they partner closely with), many of which are given as bonus for completing some objectives (mostly involving courses that let you know how these very coins actually work).

Learning material

The learning aspect can’t be underestimated. Once you’ve settled on the exchange, you’ll want to complete your knowledge of trading by absorbing some digestible and accessible information. That’s why many exchanges include at least some semblance of the informative content.

Coinbase has a stylish blog with:

- generally helpful articles

- tutorials and regular

- market updates

It means you’ll be able to understand what you’re actually doing when you press various buttons as well as compare the data from different weeks to see the general trend of, say, Bitcoin market. You can do all that under one single roof.

It’s sad that Coinbase doesn’t have some sort of economic calendar given the sheer amount of coins they offer. Economic calendars let you see what events happen in the world (among those relevant for crypto) and how different coins may react to these developments.

But even still, blog on Coinbase is very informative, helpful, easy to read and stylish.

Issues

So, by content alone, Coinbase seems like a very good candidate for a crypto exchange. However, it’s not that simple. Many exchanges positively spoil their good score by not being able to provide some fundamental service. Coinbase is no different. They have several key problems.

- Transfer issues

This basically means you won’t be able to receive your money half the time, whether you deposit them onto the exchange or withdraw them from it. It’s actually baffling, because providers usually work very hard to provide good depositing – they either put a good effort into it or (in case of scams) support this feature exclusively.

Coinbase, based on user reviews, can’t sometimes even deposit your money – much less return it to you. All things considered, it’s probably the result of overexertion or incompetence, and not scamming. But you never know what really happens behind the curtains.

- Poor customer support

This is actually the bane of many otherwise good broker and exchanges. Whenever you can’t get your money, you’ll obviously try to contact support to either get your finances back through different means or understand why they didn’t come.

But Coinbase doesn’t seem to have any functional customer support (again, according to the user feedback). You simply can’t get to them almost always – they simply don’t respond.

Coinbase is actually notorious for having a lot of complaints at any given moment since at least 2018. It may be due to the fact that good reviews simply aren’t being posted (for some reason) or because the support is seriously atrocious. You never know.

In conclusion

Coinbase is another example of a potentially great exchange with a lot of things to offer ruined by poor customer service and management. It’s no use trying to enjoy all the wonderful material available here, because you won’t be able to draw any profit from any of it.